Protecting Yourself from Identity Theft and Fraud

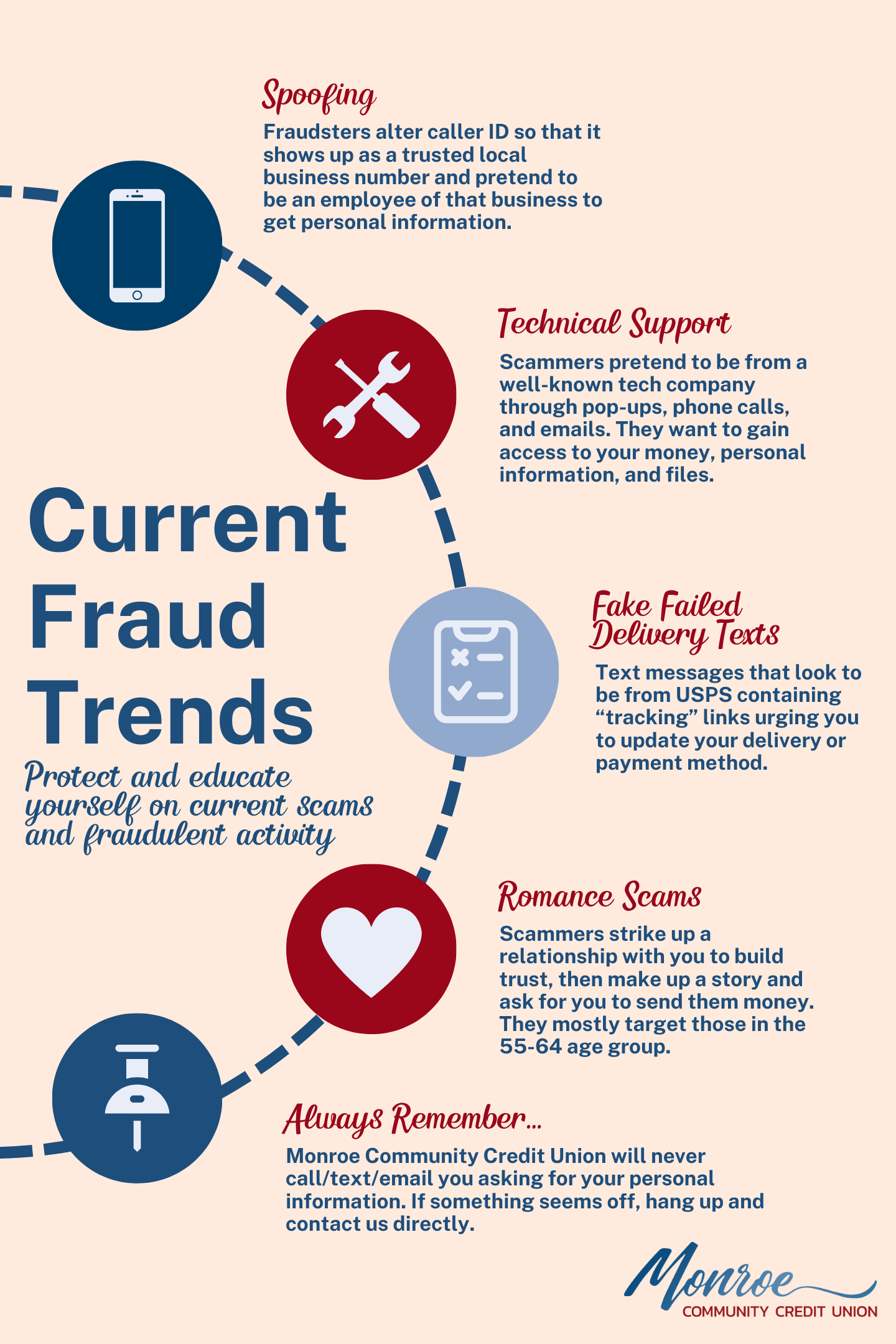

Having your information compromised or falling victim to fraud can be devastating. The best way to protect yourself against fraud is to familiarize yourself with what scams exist in our marketplace and know what your rights are should something happen. Our highest priority is protecting your account and personal information. MCCU will never call, email or text you asking for a one-time passcode, your account password, your debit card number or any other sensitive information.

- What are some common types of scams?

- How can I spot identity theft?

- How can I protect myself and others I care about from fraud and scams?

- What are some common fraud and scam issues?

Additional Resources

Students Guide - Frauds and Scams

Online Security

Taking steps to protect your personal information online is more critical than ever. Here are some tips to help you protect your identity online:

-

Invest in reliable antivirus software

-

Hundreds of thousands of malware samples are produced every single day–a trend that’s unlikely to stop any time soon. The most effective way to protect your system against worms, trojans, ransomware, potentially unwanted programs and other malicious software is to invest in a reliable antivirus solution.

-

-

Enable two-factor authentication wherever possible

-

Two-factor authentication adds an extra layer of security that is used to ensure that people trying to log in to a website or service are really who they say they are.

-

Enabling two-factor authentication means that, in addition to entering your username and password when accessing an account, you’ll also need to provide another piece of information that proves your identity. For example, some companies will issue tokens that generate a one-time use password or send you a verification code to your mobile phone.

-

-

Start using a password manager

-

The average Internet user is expected to have more than 200 online accounts by 2020. Manually keeping track of so many login credentials is next to impossible, which explains why passwords such as “123456”, “password” and “qwerty” remain so popular. Using brute force or social engineering tactics, hackers can easily break into accounts guarded by weak passwords and steal whatever information lies beyond.

-

Password managers enable you to create and store highly secure passwords on the fly, and easily enter them when prompted.

-

-

Be careful with what information you share on social media

-

Social media platforms have become a hotbed for cybercrime in recent years thanks to the sheer number of users they attract, how easy it is to create fraudulent accounts and how quickly malicious content can be distributed. Think before you click on any links that appear in your feed or personal messages (even if you know and trust the sender), be selective with friend requests and don’t share your phone number, address, place of work or any other personal information that could make it easier for someone to steal your identity.

-

Comprehensive Fraud Services for MCCU Members

Here at your community credit union, we have front row seats to the many negative effects fraud and identity theft can have on a person's mental and financial health and wellbeing. For the reason, we want to ensure our members have access to affordable fraud prevention and remediation services, should they want them. We know many companies offer these services but, in keeping with the credit union philosophy, we have found a way to provide access to the best kind of protection program for our members for a very low cost. Best of all, when you sign up for Benefits Plus services, you not only receive access to their fraud services, you also gain access to 60+ other exclusive member benefits for the low cost of just $5.95/month!

The identity theft component of our benefit program includes:

- Ultimate ID Protection

- 3 Bureau daily credit monitoring1

- Internet monitoring

- Credential vault

- Enter any personally identifying information you'd like to have monitored such as your driver's license number or email address

- Instant inquiry alerts

- Dark Web monitoring

For more information about Ultimate ID, or to learn about the 60+ exclusive member benefits that can be accessed along with the Ultimate ID services (and other benefits!) online or through their app:

1 Credit Monitoring and the ULTIMATE ID® program begins when you successfully validate your identity. An active email address is required to complete the activation process. To report an identity theft incident or for assistance obtaining your activation code, please call 877.279.6338 and speak with a dedicated ULTIMATE ID® recovery advocate. Certain restrictions and limitations apply. Visit Benefits-Plus.org for complete terms and conditions and program eligibility. No one can prevent all identity theft. The Benefits Plus® Membership Fee of $5.95 applies whether or not you activate ULTIMATE ID® and whether or not you qualify for all its services.

Monroe Community Credit Union has selected Generations Gold, Inc. a fully independent third-party benefits provider, to provide travel and other discounted services on an exclusive basis directly to Benefits Plus® Program. Monroe Community Credit Union assumes no liability for any of the third-party providers in fulfilling their services. All liabilities, claims, damages, and demands are the sole and direct responsibility of Generations Gold, Inc. and its independent services or benefits providers. Discounts received through Benefits Plus® Program may not be used in conjunction with any other discounts. Benefits and services available through the Program are subject to change without notice. Not all plans and discounts are available in all areas. Please refer to the actual policies for terms, conditions, and exclusions of coverage. View complete terms, conditions, exclusions and complete program details by visiting Benefits-Plus.org or calling 866.329.7587. © 2020, Generations Gold, Inc. All rights reserved.